CopyPasteTaxes

About CopyPasteTaxes

Let's build a public domain open source tax engine so all Americans can do their taxes using simple copy and paste.

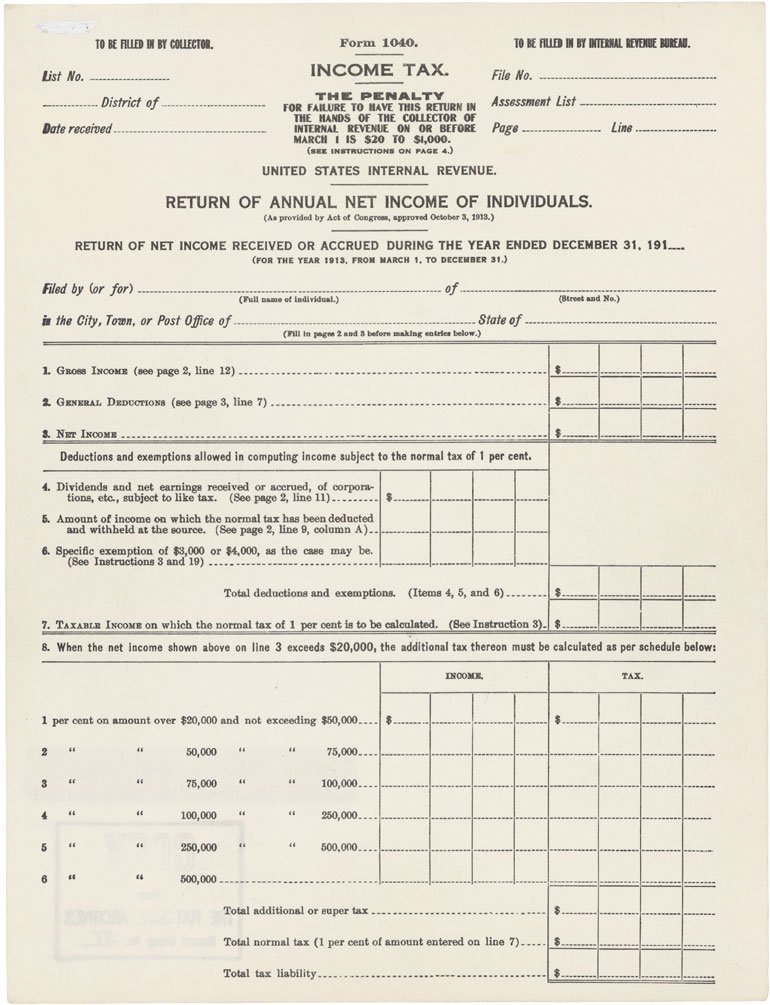

The original US Income Tax Return was a single page -- 100x less complicated than our current one. Scientists say our brains have not gotten 100x larger.

July 8, 2021 — It looks like a single person committed one dollar to the crowdfunding campaign on Indiegogo, although at this time I cannot confirm that it was not just a software bug. According to my earlier checklist the proper course of action now then is to "return to other things".

Fuck it, keep going?

The main problem with giving up on this is I'm pretty darn confident that this tech is the proper way to solve this problem, and maybe I shouldn't let a complete and utter lack of sales, business, and marketing talent extinguish the dream. Plus, I still have to do my damn taxes every year and it's going to keep annoying me to not do things the right way.

Teaming Up

I spoke to some entrepreneurs interested in the space as a business opportunity and I could see if you had the right team around this idea how perhaps it could be a good bet. The very least I can do is flesh out a prototype.

Building a v0.1

So despite the atrocious Indiegogo go, I have decided to invest at least a few more hours into building something that you can click some buttons.

February 22, 2021 — At this stage there are more questions than answers.

What are the main compile targets?

Another way to ask this question—what are all the forms that the IRS accepts from citizens that the citizen has to fill out?

These forms can be thought of as the "compile targets". CopyPasteTaxes will be a Tree Language that "compiles" (aka generates) these final forms.

These forms may be PDF. Or maybe XML. Or JSON. Or something else. I'm not sure what the IRS accepts. This is something to figure out.

It will be good to see how many types of forms there are, who files what, and how many are filed each year (and trends).

What are the supporting forms the IRS accepts?

These would be things like W2's and 1099's. How many of these types of forms are there?

How many does the average citizen send in each year?

My guess is these forms we just need to understand in terms of what fields we'd need to extract for the language for copying into the compile targets.

What are the checklists?

Who has made some great checklists on every workflow that can happen with the IRS?

What are the formulas and business logic?

This one will probably be a real snoozer. What are the all calcuations necessary to help figure out the right numbers to put in the compile targets?

How are things different for personal vs business taxes?

Should CopyPasteTaxes only do personal taxes? What about for self-employed people? It may be hard to only do personal, as that might exclude self-employed people, who may be the ones who most need CopyPasteTaxes.

How can CopyPasteTaxes generate state tax returns?

Federal is first, but then how can we make it so we compile to other state level targets as well?

How can CopyPasteTaxes help with self-employment taxes?

Should CopyPasteTaxes help with itemized expenses? What would that entail? Would a sub DSL for receipts make sense?

What are the key dates to be aware of?

Everyone knows April 15th. What are the other dates to have on the calendar?

EditFebruary 6, 2021 — Today I launched a crowdfunding campaign as one way to gauge interest in the CopyPasteTaxes project.

If we can get to $50,000, this will become a real thing.

EditFebruary 6, 2021 — In addition to the GitHub, today I created a Subreddit and Twitter for the CopyPasteTaxes project.

I am confident in the technology and believe if we can build a community we can solve this problem for the American people.

EditFebruary 6, 2021 — Your taxes should be a single text file that is easy to read. You should be able to use a nice spreadsheet to do it or a plain old notepad. Filling out your taxes each year should mostly just be updating a few lines in that text/file, and copy pasting the whole thing into IRS.gov. Experts who understand the deductions should be able to provide snippets that you can copy/paste into your taxes.

The whole thing should take just a few minutes per year, and you should be able to do it yourself, for free, if you so choose.

Proof of Concept

A tiny demonstration of how it will work can be found here.

The Plan

Here's the plan.

- ✅ Start the community

- ✅ Build a dumb little working demo

- ✅ Make a screencast

- ✅ Launch a $50K crowdfunding campaign to see if people care

- 🔲 If enough people care, build the thing.

- 🔲 If not, return to other things.